Dollar-Cost Averaging (DCA) vs. Lump-Sum Investing: Which wins ?

8/14/2025

Introduction

Should you invest a windfall all at once or drip it in every month?

Below you’ll find what major studies conclude, why lump-sum usually has the edge on expected return, where DCA shines for risk and behavior, and exactly how to implement each—plus fresh S&P 500–style simulations and ready-to-use charts.

1. What Each Strategy Actually Does

1.1 Lump-Sum Investing (LS)

- What it is: Invest the full amount immediately into your target allocation.

- Payoff profile: Maximum time in market (higher expected terminal wealth), but full early drawdown exposure.

- Typical use cases:

- Long horizon

- Confidence in staying the course

- Desire to minimize cash drag

- Transaction/minimum-size rules make many small buys impractical

- Behavioral note: Requires emotional readiness for immediate volatility and a clear drawdown plan.

1.2 Dollar-Cost Averaging (DCA)

- What it is: Split the lump into equal periodic buys (e.g., 12 months).

- Payoff profile: Reduces entry-date risk and early volatility but introduces cash drag while you wait to deploy.

- Typical use cases:

- Higher loss aversion or fear of “buying the top”

- Need for a disciplined on-ramp

- Training a new investing habit

- Behavioral note: Works best when fully automated and not paused by headlines.

2. What the Evidence Says

- Lump-sum usually wins on return. Over long horizons and many datasets, immediate investment tends to outperform phasing-in because more money compounds earlier.

- DCA’s purpose is risk/behavior—not beating LS. It smooths early outcomes and helps avoid analysis paralysis or regret from a poorly timed single entry.

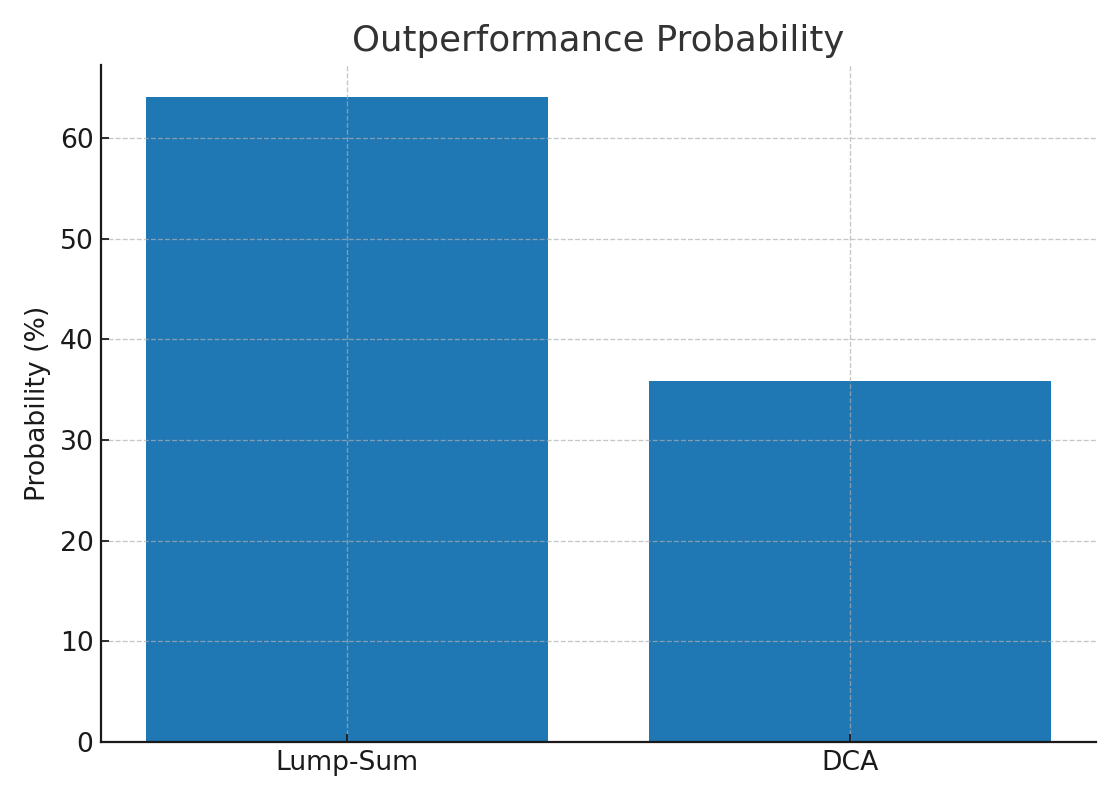

- Win-rate intuition: In historical samples and large simulations, LS finishes ahead a clear majority of the time; DCA can outperform when a sizable drawdown follows your initial entry point.

- Example (2000–2020): A widely cited S&P 500 case shows LS ending far ahead of a 12-month DCA due to cash drag in an overall rising market.

- Caveats: Outcomes depend on sequence of returns, cash yields, fees/taxes, and adherence to the plan.

3. Why LS Usually Wins (The Math Intuition)

- Positive drift: Equities have a positive long-run risk premium; earlier exposure → higher expected wealth.

- Cash drag: DCA keeps part of your capital idle while markets, on average, rise; even if idle cash is in T-bills, long-run equity premia typically exceed risk-free rates.

- Variance trade-off: DCA lowers entry variance and early regret risk—even if its expected outcome is lower.

- Back-of-the-envelope model: If price follows compounded growth with noise, LS lets more dollars compound for longer; DCA deliberately delays exposure, trading return for smoother early risk.

- Formula example:

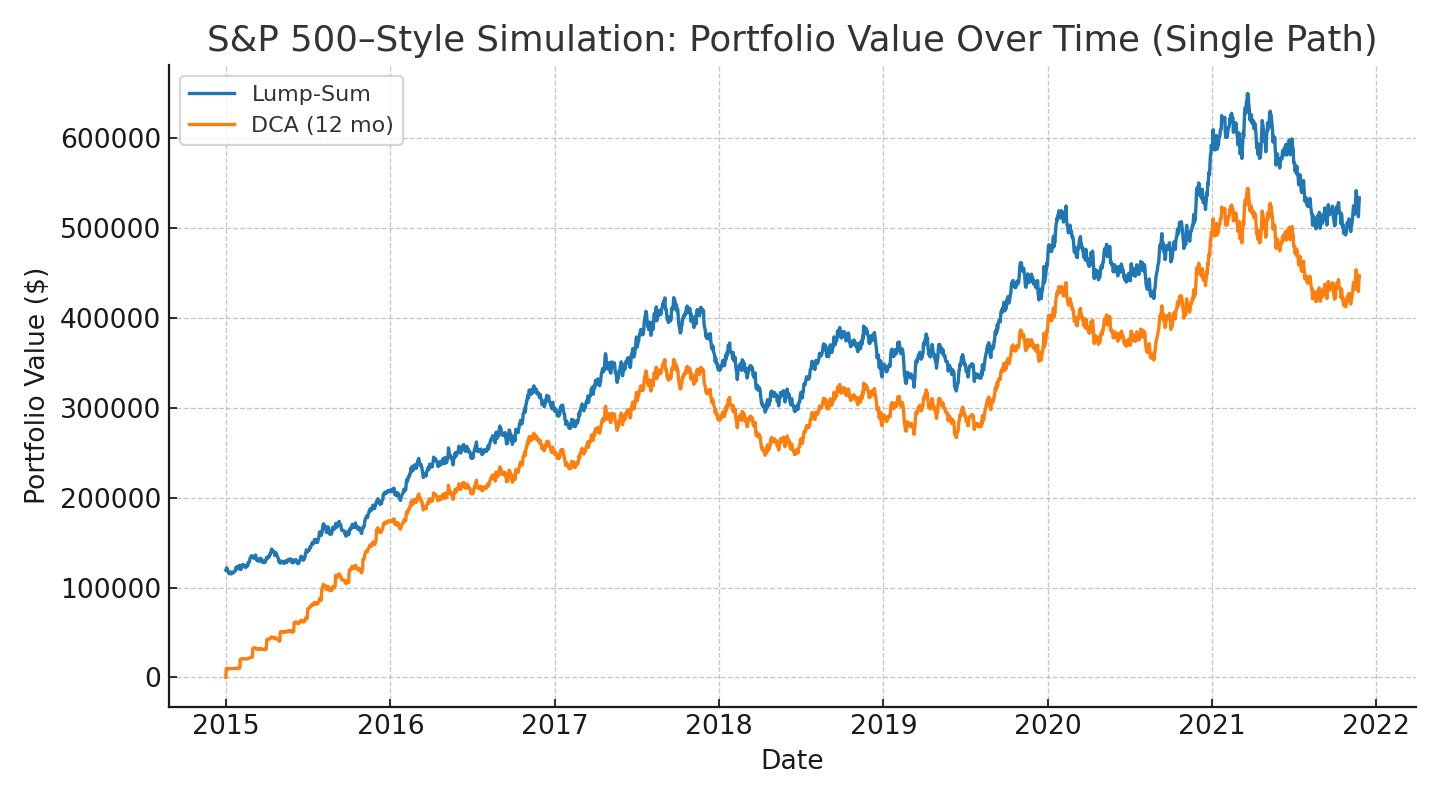

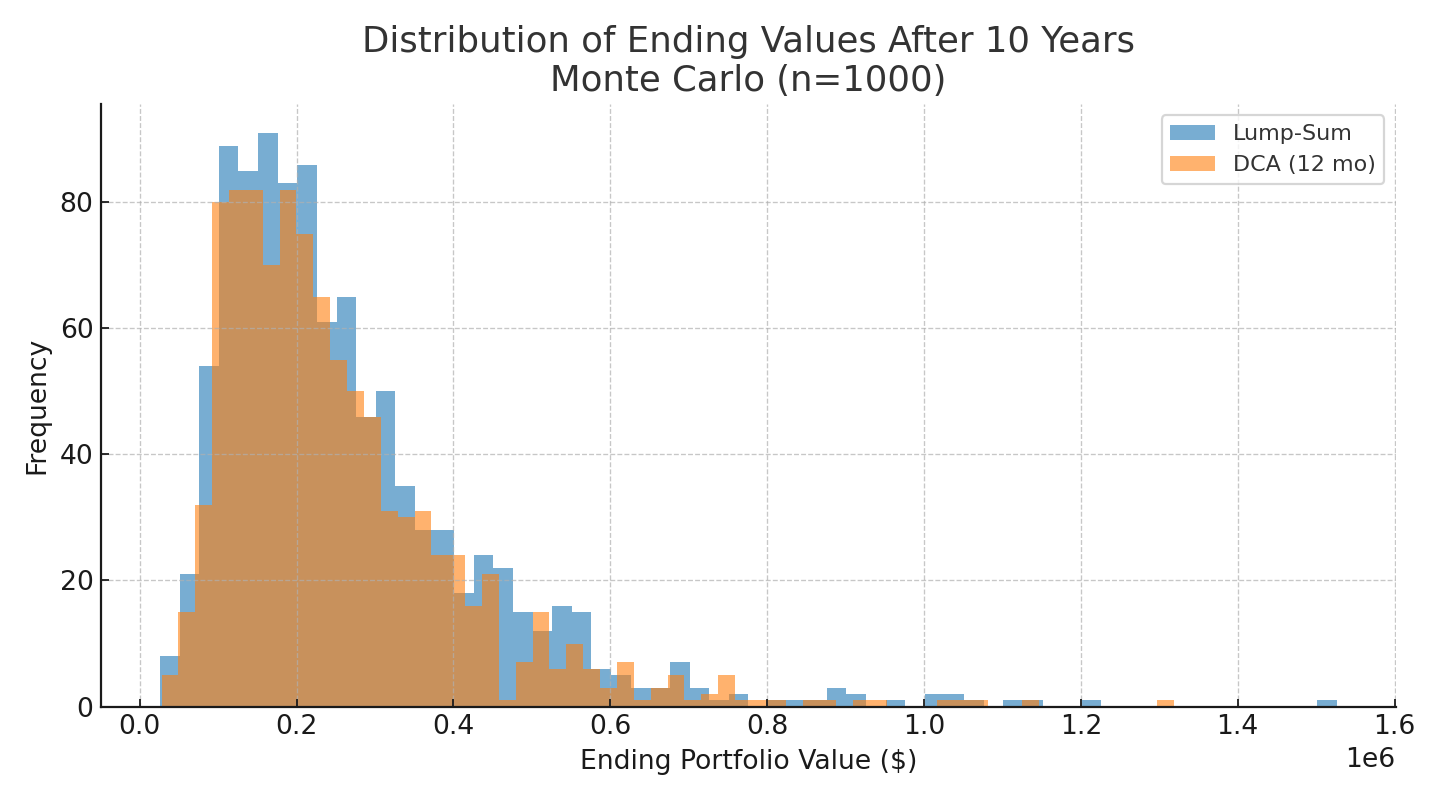

4. S&P 500–Style Simulations (Educational)

- Setup: 10-year Monte Carlo (geometric Brownian motion), μ = 8%, σ = 18%, n = 1,000 paths.

- LS: $120,000 invested on day one.

- DCA (12 months): $120,000 in 12 equal monthly buys (idle cash 0%).

- Result: LS finished with a higher final value in ~64.1% of runs—consistent with the typical “~two-thirds” historical edge for lump-sum.

- How to read the charts: If the path rises early, LS pulls ahead; if it drops early, DCA narrows losses and can lead temporarily—or even at the end for those paths.

- Assumptions: No dividends, fees, or taxes; constant parameters; 0% idle cash yield. Illustrates cash-drag vs. timing-risk trade-off, not a forecast.

5. When Each Strategy Tends to Win

5.1 Lump-Sum Advantages

- Markets rise soon after entry (common over long horizons).

- Cash yields are low relative to equity returns.

- You’re comfortable with early volatility and have a clear plan.

- You’re consolidating accounts and want to simplify quickly.

- A tax-advantaged window or employer match timing favors a prompt allocation.

5.2 DCA Advantages

- You start right before a drawdown or choppy period.

- You want regret control and a smoother on-ramp.

- You’re highly risk-averse early on.

- You’re practicing execution and avoiding second-guessing.

- You fear going “all in” and then abandoning the plan—DCA can keep you engaged.

6. Implementation: Exactly How to Do It

6.1 Lump-Sum (One-and-Done)

- Define target allocation (e.g., global equity + bonds).

- Invest immediately to target weights via low-cost index funds/ETFs.

- Automate rebalancing (calendar or threshold rules).

- Pre-write a drawdown playbook (how you’ll rebalance or add) to avoid panic.

- Pros: Highest expected terminal wealth; maximum compounding.

- Cons: Full immediate timing risk; higher regret if unlucky entry.

- Refinements: Trade during liquid hours, consider marketable limits, batch across accounts to reduce slippage.

6.2 DCA (12 Months Is Common)

- Split the lump into 12 equal buys on a fixed day each month.

- Park remaining cash in a cash/T-bill vehicle (mind settlement/currency).

- Automate the schedule and don’t pause due to headlines—discipline is the edge.

- Pros: Lower initial volatility; easier behaviorally; avoids “buying the very top.”

- Cons: Cash drag → lower expected outcome than LS in most long-run scenarios.

- Refinements: Calendar triggers + backup reminder; if a buy date is a holiday, execute next session.

6.3 Useful Hybrids

- Front-load hybrid: Invest 50–70% now, DCA the rest over 3–6 months—shrinks drag vs. pure DCA and trims timing risk vs. pure LS.

- Rule-based pacing: Accelerate buys after large drawdowns (predefined rules only).

- Valuation-aware guardrails: If valuations are extreme, adjust the DCA slope modestly—write rules in advance to avoid emotional overrides.

7. Fees, Taxes, and Frictions

- Transactions/spreads: DCA creates more tickets (usually minor with modern brokers; check cross-currency costs).

- Expense ratios: Favor low-cost index funds/ETFs; small fee differences compound over decades.

- Dividends & withholding: Reinvest; mind cross-border tax rules and treaty rates for international funds.

- Tax timing: If realizing gains to fund the lump, consider lot selection and whether staggering helps in your jurisdiction.

- Rebalancing frictions: Threshold rebalancing can reduce turnover vs. fixed schedules; watch wash-sale rules in taxable accounts.

- Operations: Confirm settlement times, FX fees, minimum lot sizes; use DRIPs where appropriate.

8. Risk Metrics & Sequence Thinking

- Entry variance: LS concentrates entry risk; DCA spreads fill prices and reduces the dispersion of initial outcomes.

- Sequence-of-returns risk: LS bears full downside if a drawdown hits immediately; DCA softens that early sequence hit but lags if the market rallies.

- Max drawdown & time-under-water: DCA typically reduces max-to-date loss during the first months; the gap narrows as the plan completes.

- Cash yield vs. equity premium: Higher cash yields reduce DCA’s drag but rarely eliminate it over multi-year horizons.

- Stress testing: Compare a −20% in 3 months start vs. a +10% in 3 months start—LS dominates in the latter, DCA helps in the former.

9. Variants & Related Strategies

- Value Averaging (VA): Target a growth path; buy more after declines and less after rises—more complexity and trades; can morph into timing without discipline.

- Threshold DCA: Predefine accelerators (e.g., invest two tranches at −10%, three at −20%).

- Volatility-aware pacing: Modestly increase tranche size when realized volatility spikes; reduce when it fades (rules-based).

- Cash-management overlay: If idle cash earns a yield, track and credit interest to future tranches.

10. Behavioral Finance Toolkit

- Pre-commitment: Write your playbook and sign it.

- Automation: Calendar rules, standing orders, confirmations.

- Friction design: Remove steps between you and the buy (saved baskets, preset order sizes).

- Journaling: Record each tranche or the lump decision and the rationale; review quarterly to reinforce process over outcome.

- Support system: Use an accountability partner to keep to the rules during volatility.

11. Case Studies

- Rising market (2000–2020): $120k LS materially outperforms a 12-month DCA—classic cash-drag example in an uptrend.

- Volatile/bear starts (e.g., 2022): Many advisors paced entries to manage anxiety and keep clients invested—behavioral adherence often beats theoretical optimality.

- International & currency: Non-USD investors should weigh FX costs, home bias, and hedged vs. unhedged exposures.

12. A Practical Decision Framework

- Horizon ≥ 5–10 years & comfortable with drawdowns → LS.

- High anxiety about timing → DCA over 6–12 months.

- Split the difference: Invest 50–70% now, DCA the rest over 3–6 months.

- Automate everything; add a quarterly review to confirm adherence (don’t re-argue based on short-term noise).

13. FAQs

- Does DCA beat LS? Usually no—DCA’s edge is risk/behavior, while LS wins on expected outcome.

- When can DCA outperform? When a large drop follows your would-be LS entry.

- Best DCA length? 6–12 months is common; beyond 18 months, drag often dominates.

- Which day of month? Pick and stick—consistency matters more than precision.

- Idle cash in T-bills? Reasonable; may offset some drag.

- DCA into bonds? Often deployed faster given lower volatility.

- Crypto/high-vol assets? Smaller tranches, longer ramps, strict rules.

- Already LS’d and markets fell? Not a failure—rebalance per plan.

14. Primary Sources

- Vanguard Research — Cost averaging: Invest now or temporarily hold your cash?; and Lump-sum investing versus cost averaging.

- RBC Global Asset Management — Understanding dollar-cost averaging vs. lump-sum investing (article + PDF).

- Investopedia (Nuveen example) — Dollar-Cost Averaging Into the S&P 500: Does It Really Work?

- Cho & Kuvvet (2015) — Dollar-Cost Averaging: The Trade-Off Between Risk and Return, Journal of Financial Planning.

- Merlone & Pilotto (2014) — Dollar Cost Averaging vs Lump Sum, Winter Simulation Conference.

- Dimensional — Taking Stock of Lump-Sum Investing vs. Dollar-Cost Averaging.

15. Glossary

- Dollar-Cost Averaging (DCA): Fixed-interval investing regardless of price.

- Lump-Sum (LS): Invest the entire amount at once.

- Cash Drag: Return lost by holding cash during an on-ramp.

- Sequence Risk: Sensitivity to the order of returns, especially at the start.

- Rebalancing: Trades/contributions that restore target weights.

- Drift: Natural deviation of allocations as assets move differently.

16. Templates & Checklists

- LS one-pager: Objective, target allocation, trade window, order types, rebalancing rule, drawdown plan, “ignore these headlines” list.

- DCA one-pager: Tranche size, schedule, holding account, automation steps, catch-up rule, completion date, post-completion rebalance plan.

- Hybrid note: Initial %, monthly %, accelerators on drawdowns (predefined), sunset date.

17. Bottom Line

- LS: Higher expected return, higher immediate timing risk.

- DCA: Lower early risk/regret, lower expected wealth (cash drag).

Pick the plan you can execute flawlessly—a slightly “less optimal” plan you stick with beats the perfect plan you abandon.